How to Change Spending Habits: 11 Proven Steps To Master Your Finances

Nov 25, 2023

By Will Moore

Are you spending more than you should? Or do you feel like you have no control over your money? You are not the only one. Many of us find ourselves falling into the trap of bad spending habits.

Whether it's impulse buying or not tracking expenses, these habits can significantly impact our financial well-being. But here's the good news: spending habits can be changed like any habit. This article offers a step-by-step guide on how to change spending habits that hurts your wallet, steering you toward better financial health.

How to Change Spending Habits:

STEP 1: Audit Your Current Expenses

A crucial first step in reshaping your unhealthy spending habits is to conduct a thorough audit of your current expenses.

Auditing your expenses is like holding a mirror up to your spending patterns. It reveals the reality of where your money is going, highlighting areas where you might be overspending without even realizing it.

How to Conduct an Expense Audit:

Gather Financial Documents: Start by collecting bank statements, credit card bills, and receipts. This gives you a wide view of your spending.

Categorize Your Expenses: Break down your spending into categories like groceries, entertainment, utilities, and so on. This categorization helps in identifying habitual spending patterns.

Identify Non-Essential Spending: Look for areas where you might be indulging in impulse buys or unplanned purchases. These are often the first areas where you can cut back.

Compare Against Your Income: Assess how your total expenses measure up against your income. This comparison is crucial in understanding the impact of your spending on your overall financial goals.

Use Tools to Track: Employ budgeting apps or spreadsheets to track and analyze your expenses. These tools make the budgeting process more manageable and help keep you accountable.

Example:

Imagine you're a typical working professional. Each month, a good chunk of your income goes towards dining out, online shopping, and other leisure activities. You may not realize it, but these small daily expenses add up quickly, diverting funds from essential financial goals like building a savings account or paying off debt. By auditing your expenses, you get a clear picture of these spending patterns and can make informed decisions to create a more balanced budget.

STEP 2: Pinpoint Your Spending Triggers

After auditing your expenses, the next vital step is to pinpoint your spending triggers. These are specific situations or emotions that spur you to make random purchases or indulge in impulse buying. Understanding these triggers can help build better spending habits.

Some Common Triggers:

Emotional Spending: Studies show emotions like stress, boredom, or even celebration can lead us to spend impulsively. Reflect on times when your emotions might have led to unnecessary purchases.

Social Influences: Social gatherings or peer pressure can also prompt spending money. Think about instances where you might have spent more due to social situations.

Convenience and Accessibility: The ease of online shopping or having credit cards at hand can make it tempting to spend. Notice how convenience might be affecting your spending decisions.

Marketing and Advertisements: Be aware of how marketing strategies, like limited-time offers, provoke you to spend more.

Taking Control:

Once you've identified these psychological triggers, you can implement strategies like habit stacking to counteract them.

For instance, if emotional spending is a challenge, consider pairing the urge to spend with a healthier habit. Every time you feel the impulse to spend emotionally, redirect that energy into a hobby or physical exercise.

This could mean, that after feeling stressed (which usually leads you to shop online), you instead spend 30 minutes on a hobby like painting or go for a run. The idea is to create a new habit loop where the trigger (stress) leads to a different, more positive action (hobby or exercise), reducing the likelihood of overspending.

By becoming more mindful of these habit triggers and actively working to counteract them, you’re not just adjusting a single habit; you’re reshaping your entire approach to personal finances and developing success habits that will serve you well in the long run.

STEP 3: Design SMART Financial Goals

Now that you understand your spending triggers, it's time to set financial goals that are clear, achievable, and motivating. SMART goals - Specific, Measurable, Achievable, Relevant, and Time-bound - provide a framework that helps transform vague aspirations into concrete objectives.

How to Craft Your SMART Financial Goals:

Specific: Define what you want to achieve with your finances. Instead of a vague goal like “I want to save more money,” specify an amount, like “I aim to save $200 a month.”

Measurable: Ensure that you can track your progress. For instance, if your goal is to reduce debt, keep a record of how much you pay off each month.

Achievable: Set realistic goals. Aiming to save money that far exceeds your current capacity can lead to frustration. Assess your budget and set goals that challenge you without being unattainable.

Relevant: Align your financial goals with your larger life objectives. Whether it’s saving for a home, investing in education, or preparing for retirement, your goals should reflect what matters most to you.

Time-bound: Give yourself a deadline. Having a time frame, such as saving a certain amount by year’s end, creates a sense of urgency and commitment.

Implementation in Daily Life:

Imagine you're aiming to cut back on spending money on dining out. A SMART goal here could be: "Reduce restaurant expenses by 50% over the next three months." This goal is not only specific and measurable but also achievable, relevant to your broader objective of saving money, and time-bound.

Reward Yourself for Good Behavior

Positive reinforcement can be a powerful motivator. Set milestones in your financial journey and reward yourself when you reach them. These rewards should be aligned with your financial goals and not counterproductive. For instance, if you've avoided using your credit card for a month, treat yourself to a modest outing instead of an expensive splurge. The idea is to gamify your life where you get rewards level up and feel good about your successes in a positive way.

STEP 4: Craft a Budget That Fits Your Lifestyle

With your financial goals set, the next pivotal step is creating a budget that resonates with your lifestyle. A budget acts as a roadmap, guiding your spending decisions and helping you save money while still enjoying life’s pleasures.

How to build a personalized Budget:

Income Assessment: Start by calculating your total monthly income. This includes your salary, any side incomes, and other revenue streams.

Fixed vs. Variable Expenses: Differentiate between fixed expenses (like rent, utilities) and variable ones (like groceries, entertainment). Fixed expenses are consistent, while variable expenses fluctuate and usually offer more room for adjustment.

Allocate Funds Wisely: Divide your income among necessities, savings, debt repayment, and discretionary spending. Use the 50/30/20 rule as a guide: 50% on needs, 30% on wants, and 20% on savings or debt reduction.

Flexible Spending Account: Consider having a buffer for unplanned purchases or impulse buys, but keep it within limits to avoid overspending.

Regular Reviews: Your budget should be a living document. Regularly track and adjust it based on changes in your income or lifestyle.

STEP 5: Utilize Cash-Only for Discretionary Spending

According to a survey, 84% of Americans with a budget exceed their limit, and 44% of them often pay with a credit card when they do. Therefore, adopting a cash-only approach for discretionary expenses is an effective way to cut overspending. This method involves using physical cash for non-essential purchases, adding a tangible element to spending that can help control impulse buying.

Implementing the Cash-Only Method:

Determine Discretionary Budget: Based on your monthly budget, decide on an amount you're comfortable spending on non-essentials like entertainment, dining out, or hobbies.

Withdraw Cash: At the start of each month or pay period, withdraw this amount in cash. This is the limit you set for yourself for all discretionary expenses.

Physical Reminder: Using cash provides a visual and physical reminder of your spending. As you see the cash depleting, it prompts a more conscious decision-making process about each purchase.

Avoid Using Cards: Leave your credit and debit cards at home when you know you'll be tempted to make unplanned purchases.

For instance, if you allocate $200 for dining out and entertainment per month, withdraw this amount in cash at the beginning of the month. When you go out, only use this cash to pay for these activities. This method naturally limits your ability to overspend, as once the cash is gone, it signals that you've reached your limit for the month.

The Broader Benefits:

This approach not only helps in managing expenses but also instills a sense of discipline and mindfulness in spending. You become more aware of each dollar you spend. Over time, this practice can significantly change your spending habits, and establish a healthy relationship with money. Remember small changes lead to big results in transforming your life

STEP 6: Align Spending with Core Values

To cultivate better spending habits, it's essential to ensure that your spending aligns with your core areas of life. This alignment creates a fulfilling sense of purpose in your financial decisions, moving beyond mere cost-cutting to building a lifestyle that reflects who you are and what you truly value.

Steps to Align Spending with Values:

Define Your Core Values : Reflect on what matters most to you. Is it family, health, career growth, or perhaps giving back to the community?

Evaluate Spending Against Values: Analyze your expenses and see how they match these values. Are your major expenditures helping you progress toward what you deem important?

Adjust Budget Accordingly: Redirect funds from less meaningful areas to those that resonate more with your values. For instance, if health is a priority, you might choose to spend more on a gym membership or healthy food options.

This mindfulness can significantly reduce extra purchases and ensure that your money is being used in ways that help you gain momentum in life.

STEP 7: Adopt a Weekly Meal Planning Habit

To change spending habits, try planning your meals weekly. It will help you save money and eat healthy.

Ways to Integrate Meal Planning into Your Routine:

Weekly Meal Schedule: Start by drafting a weekly menu. Plan your daily meals, including breakfast, lunch, dinner, and even snacks.

Smart Grocery Shopping: With your meal plan in hand, create a shopping list. Stick to this list when you visit the grocery store, which helps in avoid overspending on unnecessary items.

Bulk Purchases and Discounts: Look for opportunities to buy in bulk or take advantage of sales, especially for non-perishable items. However, be cautious not to buy more than you need.

Prep and Store: Dedicate time to meal prep. Cooking in batches and storing meals can save time and reduce the temptation to order takeout, especially on busy days.

How to Change Spending Habits: The Benefits Beyond Budgeting:

By implementing a weekly meal plan, you'll find that you're not only saving money but also reducing food waste. This approach makes you more conscious of your food consumption and helps you live a balanced life.

STEP 8: Cut Subscription Services You Rarely Use

An often overlooked aspect of personal finances is the money spent on subscription services. Many of us sign up for various streaming platforms, magazines, or gym memberships but rarely utilize them to their full potential. Regularly evaluating and pruning these subscriptions can lead to substantial savings.

How to Evaluate Your Subscriptions:

List All Subscriptions: Make a comprehensive list of every subscription service you're currently paying for, including digital streaming, software, fitness classes, and more.

Assess Usage and Value: Reflect on how often you use each service. Does it add significant value to your life, or could you do without it? Sometimes, we hold onto subscriptions out of habit rather than necessity.

Decide What to Keep: Prioritize subscriptions that align with your financial goals and core values. For example, if maintaining fitness is crucial for you, keep the gym membership but consider cutting the rarely-used music streaming service.

Alternative Solutions: Look for more cost-effective alternatives. Perhaps, a pay-per-use model works better for certain services, or free versions can be just as effective.

The Ripple Effect of Minor Adjustments:

Such minor adjustments in your monthly expenses can have a larger impact over time. It's not just about immediate financial savings; it's about cultivating a mindset of mindful spending. This method makes you think about how useful and valuable your expenses are, so you can spend better and use your money more wisely.

STEP 9: Practice Gratitude to Curb Materialism

Often, the urge to indulge in impulse buying or overspending stems from a feeling of lacking, where acquiring new items seems like a path to fulfillment. Living in gratitude shifts this perspective, encouraging appreciation for what you already have, thus reducing the constant desire for more.

Ways to Integrate Gratitude into Daily Life:

Daily Gratitude Journaling: Take a few minutes each day to write down things you're grateful for. This could range from meaningful relationships and achievements to simple joys like a good meal or a sunny day.

Mindful Reflection: Before making a purchase, especially a significant one, pause to consider if this aligns with your core values. Reflect on whether this purchase is out of need or a momentary want.

Appreciating Non-Material Aspects: Shift your focus from material possessions to experiences and relationships that bring joy and fulfillment. This change in focus can significantly alter your spending plan, prioritizing more meaningful expenditures.

STEP 10: Implement a 30-Day Wait Rule for Big Purchases

This rule involves waiting for 30 days before finalizing any substantial spending decision. It's a straightforward yet powerful way to cut extra expenses.

How the 30-Day Rule Works:

Pause Before Purchasing: When you encounter a potential big purchase, instead of buying it immediately, put it on a 30-day waiting list.

Evaluate the Necessity: Over the 30 days, assess how often you think about the item. If it frequently comes to mind as something essential, it might be worth the investment.

Revisit Your Budget: After the waiting period, revisit your budget. Does this purchase fit within your financial constraints and goals?

Decide with Clarity: After 30 days, you’re likely to have a clearer perspective on whether the purchase is driven by a genuine need or a momentary desire.

Example: Imagine considering a pricey new laptop. Instead of purchasing it on a whim, wait for 30 days. During this period, assess how your current laptop is serving your needs. Often, by the end of the waiting period, the urge to buy diminishes, or you might realize that a less expensive model would suffice, saving you money for other priorities like adding to your savings account or reducing debt.

STEP 11: Use Technology to Regularly Assess Financial Progress

Regularly assessing your financial progress is key to maintaining and enhancing good spending habits. This step involves periodically reviewing your budget, tracking your expenses, and evaluating your adherence to your financial goals. By incorporating technology tools like a weekly habit tracker app into this process, you can streamline tracking and gain better insights into your financial health.

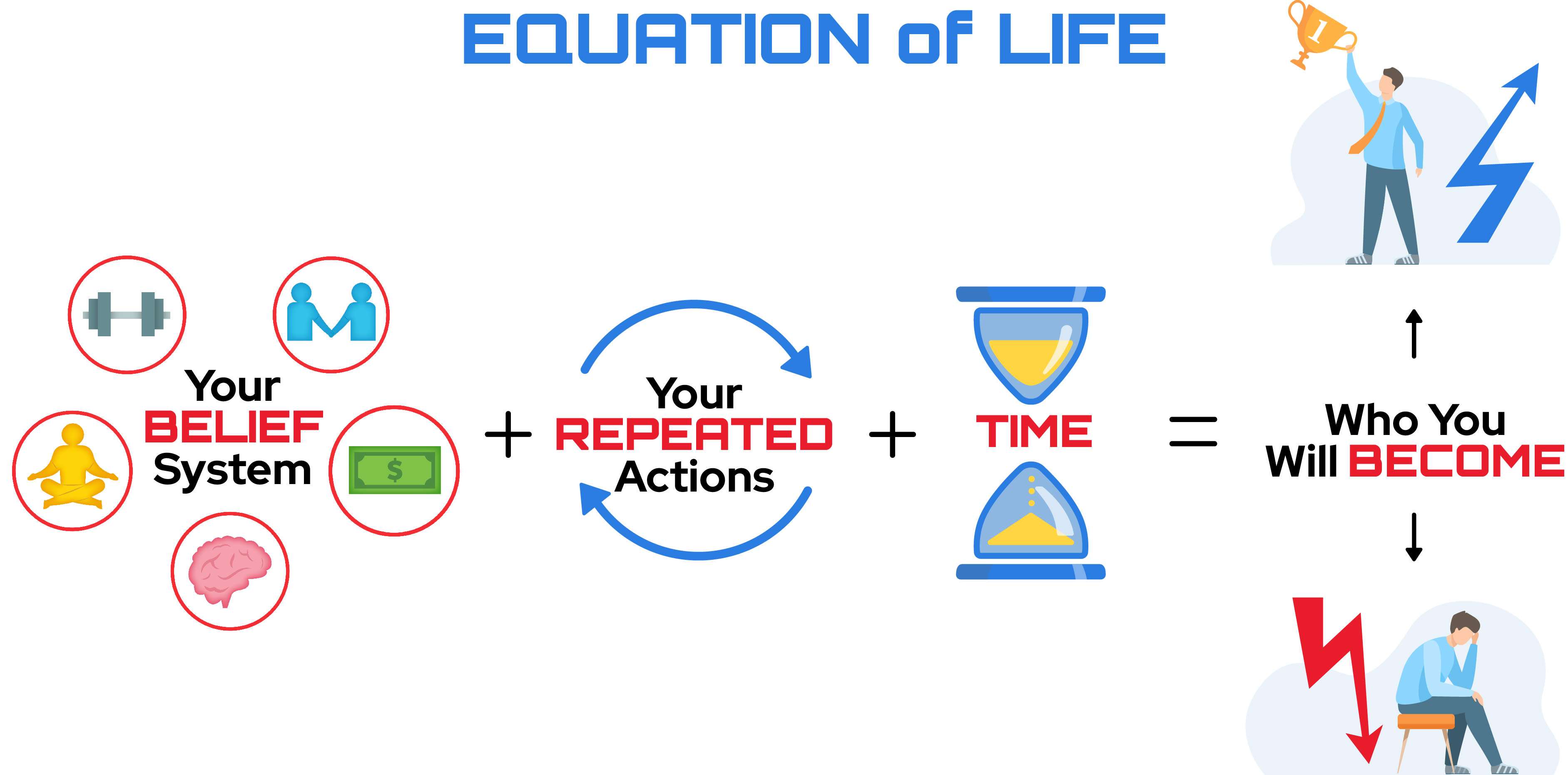

The Equation of Life: A Blueprint for Financial Transformation

So, we’ve been talking about changing spending habits. All these strategies we’ve discussed, fit into this thing called the “Equation of Life” from the Moore Momentum System. It’s pretty simple:

Your Belief System + Your Repeated Actions + Time = Who You Will Become.

First up, your belief system. It all starts with figuring out what makes you spend money. Could be emotional, could be social, it doesn’t matter. What’s important is that you understand it, because it shapes how you think about money.

Next, your repeated actions. Every decision you make, every action you take to manage your spending, it all adds up. Over time, these actions become new, healthier financial habits.

And finally, time. Success is a habit and changing spending habits isn’t a quick fix, it takes time. But every day, as you keep applying these strategies, you’re making progress. Small changes add up, and before you know it, you’re seeing big improvements in your financial health.

How to Change Spending Habits: Ready to Transform Your Finances?

You’ve just taken 12 steps to master how to change spending habits. These steps will also help you upgrade lifestyle. But this isn’t just about spending less. It’s the first step in a bigger journey to change your whole life, and it’s all part of the Moore Momentum system.

But we don’t stop at finances. The Moore Momentum system is designed to help you improve all aspects of your life. From boosting your health to building better relationships, we’re here to help you achieve long-term happiness and success.

Ready to get started? Take our quick 2-minute “Core Values Quiz.” 🚀🚀🚀

It’s more than a quiz; it’s your first step towards a balanced, joyful life. Discover which habits to prioritize and start building momentum today.

FAQs

1. How to create and stick to a budget? Start by tracking your income and expenses. Prioritize necessary expenses and savings, then allocate the rest for discretionary spending. Review and adjust your budget regularly.

2. What are ways to reduce credit card debt? Try to pay more than the minimum payment each month. Consider a balance transfer card or debt consolidation loan. Avoid unnecessary expenses and prioritize paying off your debt.

3. How to control impulse buying? Make a shopping list and stick to it. Wait a day or two before making big purchases. Ask yourself if you really need the item.

4. Tips for comparing prices before buying? Use price comparison websites or apps. Don’t forget to consider the quality, not just the price.

5. How to set and achieve financial goals? Be specific about what you want to achieve and by when. Break down your goals into manageable steps. Regularly review your progress and adjust your plan if needed.